To Ethereum or not to Ethereum

The good, the bad and the ugly

Years ago I read a book on what make things go viral. I can’t remember the details, but I do remember that one factor was what the author called bragging rights. I call it the keeping-up-with-the-Jones’-syndrome. People tend to jump on a bandwagon before finding out where it is going, just because everyone else is doing it. This post aims to highlight the good, the bad, and the ugly of the Ethereum block chain to help you look past the buzz and decide whether to put that web app on the block chain or not.

When a friend asked my opinion to put a document collection and processing application intended for the general public in support of the local police service on the block chain or not, my immediate response was a clear and confident no. Here’s why.

Disclaimer: I am no specialist on any of the block chain technologies and know just enough to ask the right questions and this is my objective opinion based on my personal research from an end-user perspective.

Ethereum is fast becoming one of the most popular block chains available. There is a lot of good and exciting things happening in the Ethereum space, but first things first.

A dummies guide to block chains and Ethereum

For those not familiar with block chains, the main promise that the block chain brings include decentralization, transparency and privacy for financial (for a lack of a better term) transactions.

Ethereum took the block chain technology with all these benefits to the next level by creating an entire ecosystem — including financial transactions but so much more — based on the same principles. It can thus rather be seen as a block chain technology platform than a crypto currency network like the BitCoin block chain. Anything can be put on the block chain, and that’s part of the vision of Ethereum — to create the next web (or web3).

Decentralization refers to the concept of distributed decision making and what caused the initial buzz as it was directly opposing the centralized systems of banks and financial institutions. In other words, and in rather very simplified layman’s terms, there is not one decider responsible for decisions affecting the masses and thus no single point of control. Without a single point of control the boundaries and red tape instituted by governments and financial institutions that discriminate against people considered not part of their team are broken. It makes it possible for anyone, anywhere in the world — as long as they have internet and a device — to transact with anyone else, anywhere in the world.

Just take a minute to consider the impact of that because it’s really big.

It basically means all borders between countries are removed to create a single world where all people are equal in terms of value exchange for services and goods.

It also means no more corruption and no fraud with money laundering something of the past. In an ideal world that is. Each block chain transaction is transparent and permanent meaning anyone — including you — can view all transactions that has occurred — from people you know and people you have never met.

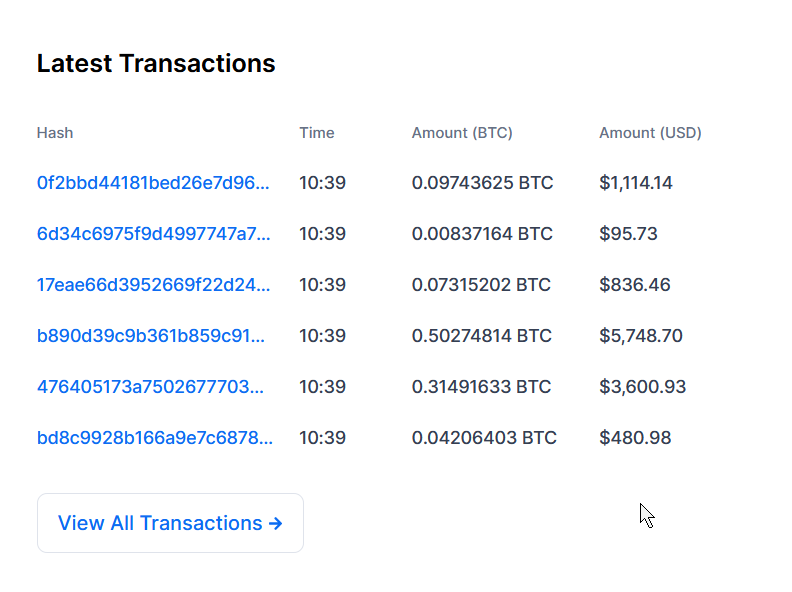

One example of what’s called a block chain explorer can be found here, where you can search for any transaction, address or block.

That means no more lies and no more secrets which I think is a massive benefit to humanity in general and the core reason why the technology became so popular.

In terms of finances though, for which the Bitcoin technology was originally intended, the biggest benefit is however the promise of zero fees, fast transactions and equality, with anyone able to receive and send currency to anyone anywhere in the world. No long bank forms to complete, high fees and long waiting times to send money across the border. No person excluded from the ability to send or receive currency, including the millions of people born ‘illegally’ in China (how can a living person be illegal?) when they weren’t allowed to have more than one child, the ‘illegal’ immigrants having risked their lives in search of a better life in a country they were not lucky enough to be born in, or those who are restricted based on their nationality from transacting with the rest of the world because of the crime of a leader they don’t even support, like Zimbabwe.

That’s a world I want to live in and a value exchange system I will support. Each person should have the right to participate in life so to speak and part of that means the ability to pay and get paid.

If banks and our current financial systems and governments were working well (meaning taking the best interest of the people as their first priority) there would be no reason for people to look for alternatives. But it isn’t working that well and it’s inevitable that it must change. It’s no longer a question of IF, but WHEN.

Digital seems like our best option going forward, and *the original* block chain the most fair.

So it makes sense that we start replacing the old financial systems with new ones and Ethereum has embarked on a journey to do just that, quite enthusiastically, if I might say so.

Ethereum, however, does not restrict itself to financial transactions like Bitcoin. You can literally put anything on the Ethereum block chain. It is the Google Play Store on the blockchain with an app for everything, starting with DeFi (decentralized finance). There are also games, market places and even job boards available with each day more apps being released.

The good — shared vision & community

Ethereum does a lot of good things that enables participation and growing the ecosystem actively. One of the my favorite things is the regular hackathons where people are supported to build new apps according to a central theme. I had the pleasure of meeting and working with some exceptional talent — a rare find indeed — and had access to some of the best minds in the industry with regular organized sessions on various topics.

This is an excellent learning and networking opportunity and I love the concept of voluntary workers. When people choose to participate in building something they are bound to be more creative and build better products. Add a salary and you have a holacracy filled with innovators and passionate creators.

The hackathon creates community and a shared vision that guides participants into a desired direction, rather than just letting everyone loose like in the Play Store, resulting in more garbage than gold. It supports people to build their vision, and immediately filter out the apps that isn’t quite ready with valuable feedback from specialists. It’s a recipe for success and a model that more work places should consider adopting.

One of the results of this community is low-code and no-code tools which makes it possible for anyone to build a block chain application at a fraction of the time that it would if you were to do everything from scratch. If used correctly you can accelerate your product development time and focus on what’s really important — namely building the right product — rather than worrying about building the product right. The biggest challenge (and this is a great challenge to have!) is to find the right lego bricks and getting them to fit correctly, which is the next huge benefit of using Ethereum.

The entire ecosystem is designed as a plug-and-play lego system. The community is strengthened even more by this attitude of sharing and re-usability, making it a collaboration, rather than a zero-sum game with only one winner. People are willing to share their skills as well as their code and expertise freely, something quite unique and exceptional and one of the main reasons why I simply can’t let go of my love relationship with software development.

The people leading the effort are extraordinary.

Another good thing about Ethereum is that they have already totally replaced the financial systems as we know it and if the banks one day stop operating, there’s already a fall-back in place and fully functional. In fact, you can do a lot more than what you can on a traditional bank with way more choices available and you the sole decision maker. The number and variety of working applications are more than what one person could possibly need, with more innovative solutions added daily.

The bad —pay to participate

The most visible pain point of Ethereum and a much debated topic is the gas fees — a ‘small’ fee charged for each transaction. I’m still to find out exactly where these fees go, but do know that a portion of it is to fund the validation processing, or more commonly known as mining in Bitcoin.

Where on the BitCoin network transactions don’t charge “gas”, on the Ethereum network each read is free, but each write will cost you gas. To complicate matters, there is no way to calculate this gas fee until the transaction is complete, so you never know exactly how much it will be. The vast number of tokens also means that you probably need to do many more transactions to complete one goal than you would, for example, when exchanging ZAR to USD, thus compounding the effects of the gas fee even more. This, however, is a problem much wider than Ethereum.

The impact of the gas fees on each write transaction is that every time you actually want to do something on the Ethereum blockchain (which in my opinion is the fundamental measure of value of anything), you have to pay. Whether it is playing a game or posting a blog, or trade your virtual crypto kitten, it is going to cost you some gas.

This, in my opinion, is the main reason why it is still so small relative to the market size available.

The justification is that it is a small fee, only a few cents (which in practice sometimes is and sometimes not and depends very much on your base for cents as the South African Rand for example is much weaker than the Dollar), and that it reduces spam. Although there is merit in this reasoning, in practice, I don’t quite agree with it. Especially when I see gas being burned, meaning it's too much (from my lay person perspective).

The current internet is free to use. Most digital products offer a free option which in today’s crowded market is essential to filter out the empty promises from the actual quality products available and to see whether it solves your problem. Free or crowdsource means building what matters and valuing user needs.

Ethereum, and block chain in general, is changing this model with providing nothing for free.

Transactions are also not immediate and can take up to 15 minutes, which is still an improvement when compared to a Forex bank transaction, but breaks the promise of fast and free transactions globally.

Ethereum 2.0 attempts to solve both the gas fee and the transaction speed problems, yet, from what I can see (and I know very little) the new staking to mine is in fact excluding rather than including more people. The argument for sharding was to make mining more accessible without specialized and expensive hardware. At 32 ETH — which at the time of writing this post was worth more than $12, 000 — you can buy a few gaming PC’s, all which can currently comfortably run mining programs. It also adds this money to be staked for a few years with penalties. So if you don’t have a high-speed internet connection with a permanently connected device running, you risk losing some of your stake.

A less visible pain point that many people probably don’t know, is that few of the apps are actually making money. Argent, a (very good!) alternative to a fiat bank, for example subsidized the gas fees in order to get people on board, which was of course not sustainable and it is changing as we speak. PoolTogether, one of the most popular savings games (and also really cool!) has not made any profit yet as most of the Ethereum startups I came across. It rather looks and feels like an expensive new toy for developers than a long-term and sustainable business opportunity. But then, Amazon made losses for the first 5 - 7 years.

It simply doesn’t make much business sense to put a document management system for government on a blockchain.

The ugly — centralizing decentralization

Ethereum might be great for a fun or personal project and to break free from the traditional fiat systems, but by far my biggest concern relates to the fundamental design principle of decentralization.

The ugly of the blockchain (DeFi specifally) is that centralized hubs that access and store personal documents are forced at all access points, thus breaking the most fundamental principle of the block chain, namely decentralization. This is of course not Ethereum or any blockchain's fault, but still something to take into consideration.

It might still be easier to open a financial account in a European run company than opening a European bank account from South Africa — where I live — but I kept running into the same wall when randomly choosing a wallet or exchange. South Africa is not supported, or getting funds into my wallet is not supported with my bank account, or getting money out is a problem. It is a similar discrimination than before based on geographic location. Probably only because they haven’t had time to catch up yet and hopefully this will change.

Most countries don’t classify crypto currencies as financial assets, thus is not considered ‘money’ that technically requires KYC. It’s rather the same as buying a sofa or a digital software program or car and I don’t need to be KYC’ed in order to do that, so why for buying crypto assets?

The reasons provided to justify the need for KYC relates to the prevention of fraud and terrorism, but this seems rather superficial seeing that all transactions are transparent on the block chain and hiding money is far easier in fiat banks than on the block chain. KYC hasn’t stopped drug smuggling or sex trafficking either, so it’s just not a good enough reason for me.

But, that’s my opinion and I have a very limited perspective. Make up your own mind.

I would just prefer that if we're going through the effort of rebuilding a system we do it differently, better. Currently, we're mostly just moving the structures that weren't working so well to web3, and it is breaking the very essence of the chain.

And the verdict is….

For investment and trading when you have extra cash on hand I highly recommend Ethereum as one of the strongest performers on the crypto currency arena. The growth is higher than most other currencies and the platform is growing exponentially and won't stop soon.

For DeFi applications Ethereum is a great alternative to fiat banking even though it only makes sense for larger transactions. Daily transactions simply doesn’t justify the cost of gas. Until you can’t buy bread and milk using crypto it won’t be globally accepted as a solution to fiat.

For building a business venture or startup that is not financial in nature, Ethereum is most probably not the best choice of technology, however. There are many other blockchains that is faster, cheaper, and more scalable.

For a document processing and storage solution provided free of charge and with high usage by the general public, Ethereum would definitely not be my recommendation. Each individual will have to create a wallet and fund for each transaction, which is more expensive and more difficult than the current paper process in place. To process each document there will need to be an estimate of 3–5 transactions at least, which means that it will in fact cost more than the paper trails currently in use.

There are of course benefits, including the permanence of records and inability to tamper with it, more accurate and real-time statistics available and more, but this can be done on existing technology.

So even in a digital world, sometimes it makes more sense to go with low-tech or no-tech to improve a user experience. Just because you can, doesn’t mean you should. Only digitize if it is an improvement.

Originally written on https://medium.com/swlh/to-ethereum-or-not-to-ethereum-2bc2bb44ec25