Are we ready for DeFi?

Comparing central finance with decentralized options

Do something that scares you every day.

I did exactly that recently by enrolling in a 30 day blockchain hackathon. What I knew about blockchain when I enrolled was that it’s a decentralized system and something I wanted to learn more about. That's it. I knew it's promises as mainstream media advertises and little more.

The promise of blockchain and crypto currencies

Blockchain technology promises increased transparency, lower costs, and being more secure than traditional banking. The blockchain technology is a public ledger that is available for anyone anywhere to see each and every transaction, while it works on a consensus basis before adding a transaction onto the chain (more later). Crypto currencies are the value for exchange tokens used to transact and secured with cryptography.

DeFi is short for Decentralized Finance, a collection of small applications called DApps on the blockchain that is rebuilding banking and finance as we know it currently in a centralized world onto the decentralized blockhain. Ethereum was the pioneer to introduce what is called smart contracts onto the blockchain layer and since a number of different blockchains and organizations have been added to the web3 ecosystem.

The web3 ecosystem built on blockchain technology shifts how we do business. Secrets and intellectual property are replaced by open-source software where everyone is invited to audit and contribute to software. Competition is replaced by co-operation with re-usable lego's that is encouraged to be re-used. Large co-located corporations are replaced by small remote only startups with volunteers contributing to open-source as and when needed to complement the small core teams.

It is revolutionizing finance as we know it as well as how we do business and work.

Over the period of the past decade or so an entire ecosystem has been put into place. But are we ready to replace centralized banking yet?

All the building blocks are definitely there. You can save, lend, stake, borrow, buy, sell, exchange, you name it! In fact, you can do much more than what you can with a traditional bank.

But how does it compare to our current banking experience? And is it ready for mass adoption?

The purpose of banks and money

Taking one step back, let’s start at the start and look at the purpose of money and banks.

Money

Money is simply a universal token of exchange that allows people to exchange goods.

In rural Mozambique, this token of exchange might be a handwritten note, also called an I-owe-you as we once delightfully discovered when we wanted to buy pao (the local bread) and the baker didn’t have change (as often happens in Africa). He wrote on a torn, dirty little piece of paper the exact amount he owed us in change, handed it to us with the pao’s, and walked away. We laughed, threw away the piece of paper, and enjoyed the rest of our holiday and our delicious coconut steamed pao’s.

But the memory stuck. In effect he promised us the change he didn’t have and the piece of paper was the written contract solidifying the promise into something tangible and concrete. It was a not-so-smart-contract, but a contract nevertheless.

In developed America this token of exchange is much fancier and called a dollar bill. But it’s the same thing. It is simply a token that promises another person that they can exchange it elsewhere in exchange for goods or services of their choice.

Money, as such, doesn’t mean that much. It’s just a piece of paper with a promise written on it. It’s worth as much as the integrity of the person who wrote it. Anybody can make promises, but it’s only worth something when you deliver on those promises.

The true value of money over bartering is that it is a universally accepted token. Everyone in the world will accept US dollars (or exchange it for a local currency) at a similar rate. This makes it possible for people buying and selling all sorts of goods and services even if the two parties don't have what the other person would need. For example, if I had spices and you silk, but I didn't want silk, we would have a problem if we were to barter. Money, however, is a universal token that allows us to get our spices without being forced to exchange it for silk.

Banks

Banks, on the other hand, is an old and outdated concept. Banks used to be physical places where you could store your gold in a safe place and in exchange would receive a piece of paper that proved you had the asset stored and can get it whenever you want.

Over the years, this form of security changed so subtly that we never noticed. Now it is digital with the goverment magically adding 0's and printing more paper to stimulate the economy. Now it is a reflection of the trust we have in a particular system or organization rather than a physical asset. We trust that banks will be able to give us back our money when we want it, however, if everyone withdraw their assets at once, the banks won't be able to honor their promises anymore.

The trust that was the primary benefit offered by banks has disappeared a long time ago.

Banks and digital money are, however, more convenient than cash or bartering so we continue using it. But there’s no need for a bank in itself and I’m struggling to compile a list of benefits as I’m writing this. I simply can’t think of a personal reason why it is better for me to bank my money rather than store cash under my pillow, except that it's convenient to carry around a piece of plastic to pay for things.

So what is the core value proposition if it is not trust and safety?

Benefits of banks

Simon says “Start with why” so let’s follow his advice.

What is the core value proposition(s) of access to banks and money? Why would someone use it? What makes it valuable and worth paying for as service? Here are the core reasons I can think of:

- Receiving interest on capital (more interest than fees) or wealth creation in the form of compound interest.

- Access to loans in order to create more assets.

- Safe store of assets.

- Ability to easily transact to buy and sell goods and services.

- Ability to pay and get paid globally (probably the most important value proposition of a digital currency).

Taking this checklist let’s see whether DeFi is a good value proposition for the average Joe on the street and compare centralized finance (CeFi) or traditional banks with the decentralized (DeFi) options available to us on the Ethereum blockchain.

CeFi vs DeFi

I compared my current Capitec Bank experience with the DeFi options available to me in my country of residence. Capitec is one of the more innovative, newer banks in South Africa. They disrupted the big five banks when they introduced low monthly fees backed by digital services requiring few bankers, branches and ATM's compared to the traditional banks. Rather than having a lot of ATM's, they partnered with local grocery stores where you can get cash back when you make a purchase at a minimal fee. The bank, the consumer and the grocery store benefits with this transaction. They also introduced self service stations with biometrics as validation for standard transactions that traditional banks need physical people to do.

From a service offering perspective, however, they have less sophisticated products on offer compared to the big 5 banks. As a rather average consumer, I see this as a benefit rather than a disadvantage though as I don't have to do extensive research and make difficult comparisons to choose the best product for me.

On the DeFi side I looked for specific offerings with a good public reputation that would allow me to perform the same functions as what I currently do with a centralize bank. Of course, there are a multitude of options available to my selection is very small but representative. So let’s compare the value proposition between DeFi and CeFi.

1. Interest rate on savings

Capitec offers 3–8.5% interest your transactional account with the full fees and interest rates available here. Simply having money in my transaction accounts offers me 3% interest, and having more than R25,000 increases it to 4.1%, which is pretty good for banks. Most months, the bank pays me to bank with them, which I feel is a fair deal as they use my money to trade and invest and earn interest while keeping it. Win-win. I like it.

On DeFi there are a multitude of options to choose from and lending rates varies from as low as 0.01% to as high as 12.27%. Selecting a reputable and trustworthy option is much harder as many of the higher interest bearing options are more risky and don't have the assets to back it, thus you need to do a lot more work to verify the trustworthiness of your selection which I think is a disadvantage compared to banks. A disadvantage, however, that I choose because at least I am in full control of where my money is invested compared to a bank.

Another huge benefit is that there’s no to little paperwork with DeFi compared to the painful, slow, and time consuming traditional bank offer. BIG benefit!

Saving on DeFi yields a steady income, however, it is extremely volatile and the service provider I use change the interest rates quite substantially as they please (or justify). At a bank the interest rates are more stable and predictable, but with more restrictions and less options.

The bigger benefit, however, to the small income from interest, is the volatile but upward trend where my money tripled over the course of a year. Simply storing money in a CeFi account vs a DeFi account, without investing, lending or trading, is more risky and volatile in DeFi, but with much higher growth potential than the no-growth of CeFi.

2. Fees

My Capitec bank account totals R6.50 per month for my account fee (which is pretty much free) with very straight forward and low transaction fees. Card transactions are free with payments R1.50 per transaction. To put things into perspective, this means a total transaction fee per month for a centralized bank account for less than 50c in US Dollars.

Comparing this to DeFi is very hard as the fees are not as straightforward or fixed. There are no standard monthly fees to have a wallet. However, each transaction includes what is called gas, or a transaction fee, plus a network fee depending on the blockchain you transact on. The gas fee and network fee changes based on the load on the network and can be as much as $30 per transaction to 30cents for the same transaction amount.

To complicate matters even more, it is often presented in the crypto format which consist of a large number of decimal points, way too complicated for an average person to exchange in their heads.

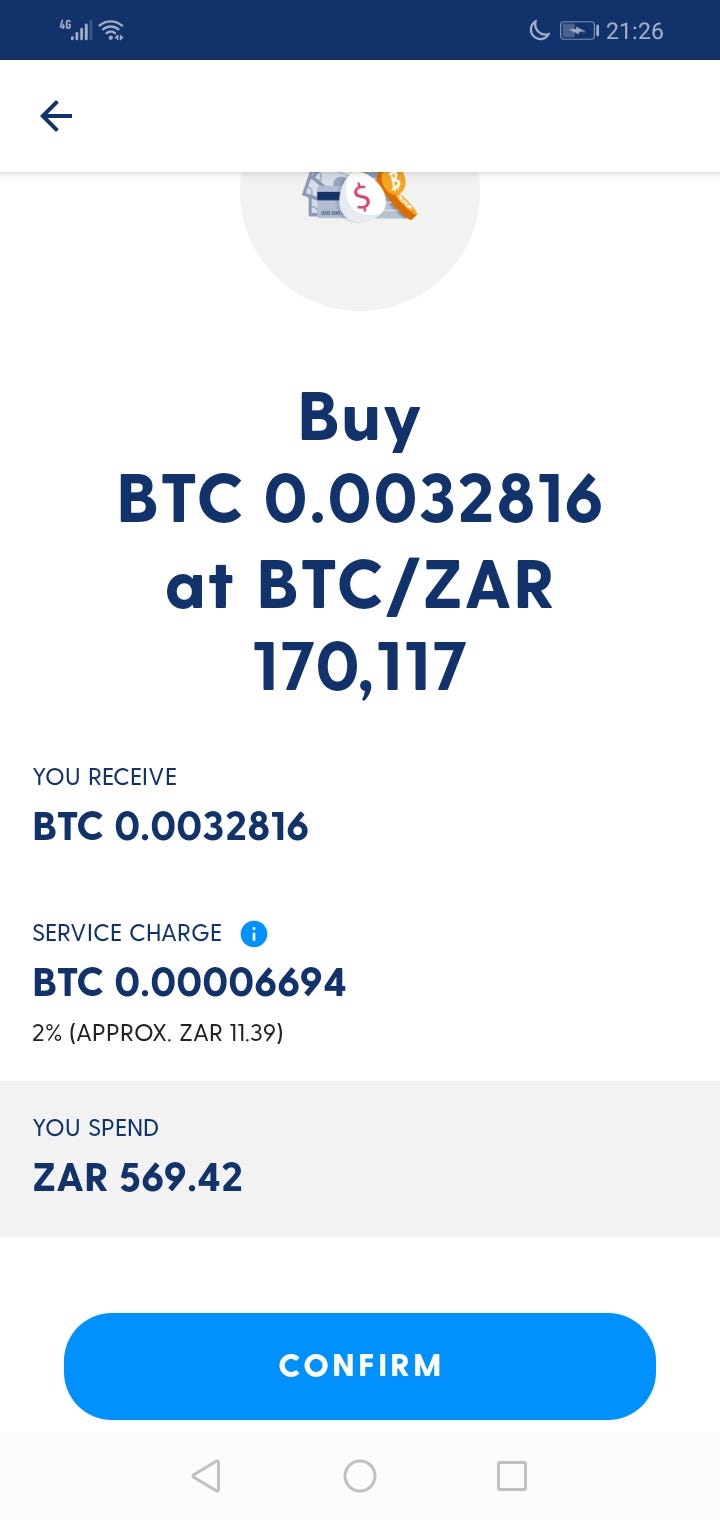

A typical transaction looks like this.

You have to get money into the blockchain, usually from fiat banks. This might cost something and is dependant on your country of residence and the service provider. In my case, a bank deposit from my local bank in South Africa is free, however, takes about 2 days, meaning I can't ever make a quick buy in such a volatile market.

Most wallets directly exchange your money into the crypto currency of your choice, while in the case of Luno, there's a holding pocket where you can keep the money in your local currency until you are ready to buy crypto. This is where things get interesting and rather expensive.

I exchanged R569.42 and I got BTC 0.0032816 at an exchange rate of 170 117 BTC / ZAR.

There was an estimated fee of R11.39 which I am not sure how it is calculated, but is about 2% of the transaction amount. I write this in italics because the impact of this is huge and the biggest barrier to mass adoption in my opinion. Imagine giving away 2% of your income just for depositing your money. No centralized bank charges this much for transactions and most salaries are deposited free of charge to the user.

Different blochains have very different fee structures, thus again something that complicates choosing assets and chains to transact on immensely compared to banks.

When you decide to use, withdraw or exchange your crypto, you again will pay a similar fee. Thus, it's great for large transactions, but extremely expensive for day-to-day expenses (what I call milk money).

The fee structure for crypto fees is overly complicated and there is different fees for buying, selling, receiving, sending and trading. On top of that, there's different fees for different chains and currencies, and each wallet and exchange offer their own fees, making it close to impossible to compare.

The upward growth of the currency compensates for the high fees and most people probably don’t put much thought into it, but all in all I lost about R61,67 on my initial investment of R1, 000 even though the growth was 15% and 32% respectively on Bitcoin and Ethereum.

The R1 000 I deposited ended up being R938,33 in value after a month. After about a year it was worth close to double though. So very unpredictable and not feasible for daily expenses.

The winner in terms of daily savings (liquid option) thus is Capitec with the ease, accessibility and stability offered. For longer term investments I would however opt for DeFi as the growth is so much higher and the fee structure is per transaction whereas with a bank it is monthly.

However, the average user wants a simple savings account and the ability to transact daily.

2. Access to loans or credit

Getting a loan at a traditional bank is paved with paperwork and extortionately high fees. Traditional banks also tend to only give money to people who don’t really need it.

If, for example, you are a business needing some startup capital or temporary loan the bank will most definitely not help you. If, however, you are a salary earner wanting a credit card to pay for a luxury holiday you can’t really afford they will happily give you the money, and in Capitec's case will add some mandatory insurance premiums and a high monthly fee on top of the interest on the debt.

On DeFi borrowing is much more accessible and risk is purely determined on your available collateral, or how much assets you have available. There is no to little paperwork to complete either (depending on the service provider). A smart contract that is not biased runs in the background and as long as you play within the rules, there's no questions asked.

The repayment rates on the debt are much lower than traditional banks offering anything from 0.3% to 16% making it a much better value proposition for those who can pay back their debt. The risk is, however, of course much higher with volatile markets and a range of different providers which have not yet build reputations like the big banks.

I don’t have any debt to compare, but I do have a credit card that I use for my daily transactions. With no overdue payments, my interest earned for the month was R0.05 and fees totaled R53.55. This fee consists of a monthly fee of R40 with the rest forced insurance. If I made use of the credit facility this monthly cost of debt would be much higher.

The winner by a high margin when it comes to access to loans is DeFi. They win on both fees, options and accessibility and there simply is no comparison between the two.

3. Safe store of assets

This is a tricky one and more complex for what my current skill level permits in terms of internet security. So let’s stick to what I do know and what it means to the average user out there.

A bank is pretty safe from a physical perspective. Hacking a bank has a low probability as most banks still run on mainframe systems (or did last time I checked). If I loose my card or my wallet is stolen, I simply report it, pay a small penalty and it is resolved. When I forget my pin, I simply reset it. No problem.

Banks also generally will honor the money in your account and unless everyone wants to withdraw their funds at the same time, you are guaranteed of getting your money back. Theoretically.

In the DeFi world it’s not so straight forward. You can choose to make use of hot or cold storage, meaning on the internet (hot) or on a hardware device not connected to the internet (cold). You can also choose wallets and exchanges which is custodial or non-custodial. A custodial service provider is similar to a bank and in effect hold your asset on your behalf, while a non-custodial option merely gives you a doorway to access your own assets on the blockchain.

Most blockchain enthusiast will opt for a non-custodial account as there's a saying that if you don't own the private key to your crypto, it's not your crypto. Although it might be more convenient to entrust your assets to a service provider or exchange, it is more risky, as blockchains can be hacked and an exchange is as good as its reputation.

If you opt for a non-custodial option, you are in full control of your assets, but as the saying goes, with great freedom comes great responsibility. There's no-one to call when you forget your seed phrase or account details. You can't reverse an accidental incorrect payment. And if the service provider aren't able to fulfil their promise, there's no-one to call. You simply have to count your losses and move on.

That being said, there are a lot of work being done to make this private key more ‘human’ and the concept of a guardian is now available. There's also easier options for private keys, including facial recognition as Zengo does which doesn't require any pin or access code, simply your face. Personally, I’m quite happy taking responsibility for my own money knowing if something happens it is my mistake and not anyone else’s.

In terms of accessibility of assets, or getting it out of safe storage, it’s generally easy enough when held in a bank.

Unlucky me, however, have emigrated to another country and even though I had enough and very legal money available, struggled to get access to it in my new country due to bureaucracy and rules in my old country. I thought it would be a simple international transaction. It ended up taking weeks and a lot of paperwork. Generally though, accessing your money in your own country should be straightforward and easy.

DeFi is the winner in this area purely because I trust mathematics and cryptography and open source code more than banks and government to treat me fairly. The technology is also evolving much faster than banks with easier and safer options increasing each day.

On the downside, however, there are a lot of options to choose from and without sound advice from someone you trust, the chances of putting your money in a fraudulent crypto wallet is much higher than with the highly legislated bank industry. So from a comfort and ease point of view traditional banking wins but from a trust point of view DeFi wins.

Given the choice, I would choose DeFi.

4. Easily buy and sell goods

Even though banks are traditionally a store for money, it is also more commonly used for transacting in day-to-day life using a card or electronic payments. Fewer and fewer people use cash and many stores prefer cards and digital money over cash. In South Africa even small vendors and business owners accept card payments for small expenses like coffee with services such as Yoco making it extremely convenient to have a bank card.

Buying on the internet is a little more complicated due to all the safety precautions but still relatively easy and streamlined.

Buying and selling goods on DeFi is much harder for someone new in the field. Where with traditional banks we’ve figured out a lot of the complexity of dealing with cross-border exchanges with services like PayPal or credit cards, in the DeFi world there are many, many, many more currencies and services to deal with and due to the legislative requirements of each country, there are different exchanges and wallets that supports different countries and currencies.

Each blockchain has a different currency (ETH for Ethereum, BTC for Bitcoin etc) and each service provider on a specific blockchain has a separate token too (like FLOW or UNI etc). Although this is a technical constraint, it is not hidden from the user and thus in effect bartering rather than the universal token as a US Dollar for exmple is when a baker barters with a tailor. I personally don't understand why no-one has solved this problem yet, as it is a very basic expectation for a user to be able to transact with the tokens they have if they can own it. This, however, is not the case and many transactions are 'impossible' for a specific app or feature due to the fact that you require a specific token to make a specific transaction.

For example, I was advised to use MetaMask as one of the most trusted wallets. However, after signing up and ready to deposit money discovered that I’m not able to deposit funds as South African cards are not supported. I then signed up at Luno, a local option, just to discover their high fees and lack of options and services. Similarly, Zengo offers state of the art technology and convenience, yet, runs on the ethereum network (I think?) and requires you to own ETH in order to complete transactions. It can be a frustrating and disappointing experience when you expect services that isn’t available, or being confused as to why you can't complete a transaction due to the underlying complexity of the cross-chain infrastructure.

Personally, I would love a global Euro type of currency. One currency that means exactly the same everywhere. Maybe in my next life…

And then there's gas and network fees, already touched on. While in principle I like the idea of gas and pay-per-use as it reduces spam and pays for the people who build the service, it is so variable that it’s simply not possible to have an exact amount in any transaction.

Coming from a lean and agile background, this means a lot of waste. You have to estimate the deposit made and always add a little to cover the gas. But you also need to take into consideration the volatility and constant fluctuation. For each transaction the same applies so you end up with small little piles of value everywhere that doesn’t really allow you to do anything with it.

The biggest disadvantage and most confusing aspect relating to daily transacting with crypto is that when you go and buy a bread, the average person can't do an exchange calculation in their head to translate 0.00212422 bitcoin or Ethereum to a local currency. When you travel and have to deal with exchanges it is easy enough to calculate a rounded up exchange between the two currencies without a calculator. R100 for example is roughly 5 US Dollars. It’s easy enough to then calculate $10 or $50. With crypto, this is impossible for even the more talented in mathematics.

I often use something like the price of coffee as baseline to determine a relative value when I’m new in a country. For example, in South Africa a cup of coffee is about R30 or $1.50 US dollars. When I travel to the US and the average price is $3.50 for a cup of coffee, I roughly know to triple my rand estimates of value when deciding on how valuable something is to me. With crypto, I haven’t figured out a hack to relate the value back to my physical day-to-day life. Maybe it just takes time getting used to.

With the presentation of digital currencies usually with a lot of decimals, this is impossible (for the normal person) making it a guessing game and quite scary and risky for a new person. Add onto that the complexity and cost of gas fees and cross-chain support, I don’t see the benefit of transacting using crypto. It only makes sense for larger purchases done less frequently.

This, I believe is the biggest barrier to mainstream adoption. Until you can't buy bread and milk with crypto, it can't replace centralized banks.

So even though I absolutely love the choices and access to financial services that DeFi offers, I choose traditional banks for their simplicity and accessibility when it comes to daily transactions right now and don't know anyone else who would choose differently.

5. Globally earn and pay people

I haven’t paid or earned crypto as a salary and can’t give an accurate opinion, but from what I do know DeFi is the clear winner here.

Except for the KYC red tape imposed by regulations, once you are on the blockchain via an exchange in your country, you’re ready to go and paying for bread at your local deli is exactly the same as paying someone in the Philippines. It thus makes much more sense using crypto for cross-border transactions and higher value transactions as the fees are more cost effective and it is much faster.

There is also much less paperwork involved in a crypto transaction than having to receive an international payment from aboard. I can simply send a QR code to request money, while if I want to be paid internationally I have to find and send my international bank details to the person wanting to pay me, as well as complete a form and submit it to my local bank in order to process the transaction. The fee for an international payment is also more expensive than a crypto transaction.

There are a hand ful of cryptooptions offering credit cards. For example Crypto.com which offers brilliant rewards for using your card. These options are however restricted to geographic locations and not accessible to everyone. I can't for example get a Crypto card in South Africa.

And the winner is….

With 3 points to decentralized banking and 2 points to traditional banks, DeFi wins, but with a small margin.

Is it ready for mainstream adoption though?

I don’t think so. Not quite yet.

The learning curve is simply too high and there are still too few fully integrated options available. Practically, until you can't buy bread and milk, DeFi can't stand alone with fiat.

And the verdict is…

Definitely start exploring the world of DeFi. If you have extra money to play with, find a good wallet and start getting your feet wet because decentralized finance is here to stay!

It is getting better by the day and I predict that it will become the preferred choice sooner rather than later.

However, be responsible and do your due diligence. With great freedom comes great responsibility.

Originally published on medium https://funficient.medium.com/are-we-ready-for-defi-16fff0c4ef37